FREE Uber Tax Info Pack

FREE 5-Day Email Course to learn the ATO’s Uber tax rules

FREE Uber Expense Spreadsheet so you never miss a deduction

FREE Uber Logbook Spreadsheet to claim your car expenses

FREE ABN & GST Registration (if you need it!)

FREE Uber Tax Info Pack

> FREE 5-Day ‘Uber Tax Essentials’ eCourse

> FREE Uber Bookkeeping Spreadsheet

> FREE Uber Logbook Spreadsheet

> FREE ABN & GST Registration

How Much Will I ACTUALLY Make From Uber Driving?

Last updated 7th June 2024

If you’re thinking about driving for Uber, it can be hard to figure out how much money you’ll actually make. Gross fees per hour vary, and after Uber’s fees, ATO taxes and your car expenses, will there ultimately be enough left to be worth your time?

If you’re thinking about driving for Uber, it can be hard to figure out how much money you’ll actually make. Gross fees per hour vary, and after Uber’s fees, ATO taxes and your car expenses, will there ultimately be enough left to be worth your time?

In this article I’ll answer the number one question every prospective Uber partner asks: How much do Uber Drivers earn in Australia? I’ll break down all the different factors that affect how much Uber drivers earn, show you the average expenses you can expect to pay, and help you estimate how much of your Uber earnings will actually end up in your pocket.

A note for UberEats drivers: the broad principles in this article are the same, but there are some obvious differences. For example, your shift timing is more around lunchtime and dinner time, GST is not relevant, and you’ll have different expenses compared to UberX drivers. But this post will still have information relevant to you. Be sure to also check out our blog post on Tax for UberEats and Food Delivery Drivers.

How Much Do Uber Drivers Make?

Working out how much the average Australian Uber driver makes is difficult because it’s different for every driver. Average fares per hour can vary dramatically depending on a number of factors:

- Where you live – in particular whether you have trips coming through as soon as you leave home or you need to travel to a busier suburb first, which takes time out of your Uber shift. The earnings of a driver who lives close to the city versus the outer suburbs will vary purely because the driver who lives further out may have to spend time driving closer into town before getting their first trip.

- Which state you live in – The various state governments in Australia have each set different levies and charges on rideshare companies. This means that Uber has to set fares differently from state to state so that they are low enough to attract passengers who are choosing between Uber, taxis, or other rideshare companies. So Uber earnings in Sydney may be different to Brisbane, Melbourne, or Perth simply because the state government has set different levies on the total fare.

- Where you drive – inner city areas tend to provide shorter trips, while further out you may pick up longer journeys and airport trips. Generally you won’t have a great deal of control over this. Where your trips take you in any given driving session is largely up to chance.

- Timing of your Uber shifts – whether you drive weekdays versus weekends, and day versus night will dramatically impact your earnings. Early in the morning airport trips will be common, and late at night you’ll have riders travelling from the inner city home to the suburbs. If you have the flexibility to choose when you drive you should experiment and keep records of your earnings to find the most profitable times and days to drive in your area.

- Surge pricing – if you have the ability to take advantage of surge periods you’ll see an increase in your hourly earnings. Some drivers are able to keep an eye on their Uber app from home and jump in the car anytime they see surge pricing. In some areas the Uber app also allows you to request trips heading towards a surge area once or twice per day. These are just a few strategies that can boost your earnings.

- Driving full-time or part-time – naturally the more you drive the more money you will earn. But also, if you only drive part-time for Uber because you have another job, study or other commitments, then you may not have as much flexibility to respond to surge pricing or profitable times of day. Another factor that we’ll talk more about below, is that there are many fixed costs of Uber driving, such as licences, car insurance and accounting fees. These costs are payable whether you drive one hour or a hundred hours per month. So the more you drive, the smaller the impact of these fixed costs.

- Events – Driving for events can be especially profitable and surge pricing is common. So if you’re available to drive for sporting matches and other cultural events in your city your average earnings will be higher. It can pay to save a ‘what’s on in your city’ website in your internet favourites, and also keep a copy of the football fixture handy when planning your driving sessions.

- Other drivers – the number of drivers on the road will always counteract these factors. Some times are more popular to drive as more drivers are available, particularly outside of business/university hours, and so there will be fewer trips per driver. Some drivers have also commented that when Uber run promotions to recruit new drivers or encourage lapsed drivers back on the road they’ll see a drop in their earnings.

As you can see, with so many variables it’s hard to estimate how much you will earn driving for Uber. Your best source of information is the various Uber drivers’ online forums, where you can connect with drivers from your local area to find out the average earnings from driving for Uber at various times of day and night. A great place to start is UberPeople, but also try googling for other Uber networks and meetups in your city.

Average Expenses and Profits for Uber Drivers

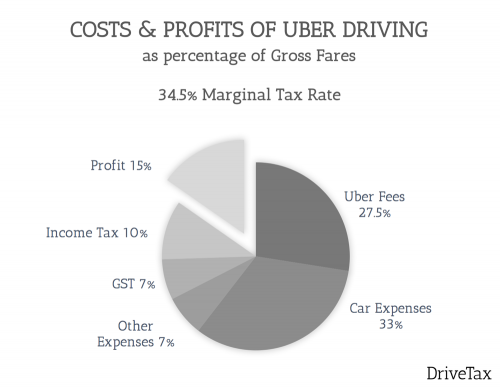

The next complicating factor is that not all of the money you earn from Uber driving actually ends up in your pocket. Uber and the ATO both take their share, and then your car running costs and other Uber expenses will also reduce how much you actually make from ridesharing. So we’ve collated data from lodging thousands of Uber BAS’s and tax returns to calculate the average Uber expenses, and how much Uber drivers make on average in Australia.

As you can see, the average Uber driver’s profit depends largely on your marginal tax rate. Your marginal tax rate is based on how much you make from employment and any other sources during the financial year. You can look up your marginal tax rate on the ATO website to see which of the charts below apply to you. (Note that in our charts we have added in the Medicare Levy of 2%)

So how do we interpret these charts? Here are two ways to look at them:

Average Hourly Earnings for Uber Drivers After Tax

To work out your average hourly rate after tax from driving Uber, take your gross fares per hour and multiply by the percentage of profits in the chart that applies to you.

- If you’re below the tax-free threshold then multiply your gross fares per hour by 26% to give your take-home pay per hour after tax.

- If you’re in the 21% tax bracket, multiply your gross fares per hour by 19% to give your hourly take home salary after tax.

- If you’re in the 34.5% tax bracket, multiple your gross fares per hour by 15% to show how much you’ll earn per hour after tax driving for Uber.

How Much of Your Uber Earnings Actually End Up In Your Pocket?

Another way to read these charts is to say that for every $100 of gross fares, the profit segment of the chart tells you how many dollars you’ll actually take home.

- If you’re below the tax-free threshold then for every $100 of gross fares you’ll take home $26.

- If you’re in the 21% tax bracket then for every $100 of gross fares you’ll take home $19.

- If you’re in the 34.5% tax bracket then for every $100 of gross fares you’ll take home $15.

Of course these charts are based on the results of other drivers, and your own figures, in particular your car running costs, may be different. So please use these percentages as a guide only.

Average Expenses for Uber Drivers

Here we’ll break down the other expense sections of the charts in a little more detail.

Uber’s Service Fees

From your gross fares Uber will deduct 27.5% for their service fee. 2.5% of this is GST, which you can claim back on your BAS at the end of each quarter, so the net cost to you is only 25%. You can read more about this in our blog post on calculating GST on Uber fares and fees.

Car Running Costs

Car running costs for Uber drivers vary from driver to driver. They depend on things like fuel efficiency, insurance costs in your area, how expensive repairs and servicing are for your model of car, and whether you own your car, have a loan, or you rent or lease. Claimable car expenses usually equate to roughly 33% of gross earnings (before deducting Uber’s fees).

It’s important to note that if the car you use Uber is a car you would own anyway even if you weren’t driving, then some of these expenses are what we call ‘sunk costs’. A sunk cost is one that you would pay anyway, even if you weren’t driving for Uber at all. Sunk costs should not be taken into account when evaluating how much money you’ll make from ridesharing.

For example, you’d have to pay the interest on your car loan regardless of whether you drive for Uber or not, so it’s a sunk cost, it’s not an additional cost caused by Uber driving. Most of your insurance and car registration fees will be sunk costs too.

So when analysing your potential income and expenses for Uber, you should only take into account additional rideshare costs over and above your regular car expenses, such as fuel, additional car maintenance, and additional fees charged by your insurance company. Sunk costs should not be taken into account.

The 33% figure mentioned above is based on tax-deductible expenses, so it doesn’t consider sunk costs. This means your profit from driving for Uber will in reality be a little higher than what is shown in our figures.

For more information on claiming your car running costs, including the rules and requirements for keeping a logbook, check out our post on How To Keep A Logbook For Uber.

Other Expenses for Uber Drivers

Rideshare drivers typically also claim deductions for their mobile phone, tolls, water and mints provided to riders, accessories for their cars (dash cams, seat covers etc), phone chargers and cables, medical and background checks, accounting fees, stationery and computer expenses. On average these costs account for another 7% of your gross earnings. Our post on Tax Deductions for Uber Drivers explains more.

GST for Uber Drivers

Yes, Uber Drivers do have to pay GST on their income, even if they earn less than $75,000. The GST on Uber income is easy to calculate, it will be 1/11th of your gross fares. You can then reduce this GST payable by claiming back the GST on your car and other expenses. Again, this varies from driver to driver. On average, after claiming expenses your GST bill will be around 7% of your gross fares. Our Ultimate Guide to GST for Rideshare Drivers explains more about how this works.

Income Tax Rates for Uber Drivers

Income tax is the most difficult cost to calculate because it depends on your marginal tax rate. As we mentioned above your marginal tax rate is based on how much you make from employment, whether a full-time job or part-time job, and any other income sources during the financial year. You can look up your marginal tax rate on the Tax Office website to see which of the charts above applies to you.

Here are some examples of how to calculate Income Tax for Uber Drivers:

- If Uber is your only source of income and your Uber profits are under $18,200 then you’ll be under the tax-free threshold and your profits will be entirely tax-free. You should refer to the first chart above.

- If you have employment income of $25,000 and drive Uber part-time as well, then the marginal tax rate on your Uber income will be 21%. This means the second chart applies to you, so on average 6% of your gross Uber earnings will go to Income Tax

- If your employment is $50,000, then your Uber income will fall into the 34.5% tax bracket, so you should refer to the third chart. Roughly 10% of your gross Uber earnings will go to Income Tax

- If your Uber income straddles two marginal tax rates, the easiest solution is to assume your tax rate will be roughly halfway between the two relevant charts.

So Is Uber Driving Really Worth It?

That depends entirely on you. If the hourly rate you’ve calculated weighs up for you as a worthwhile use of your time, then yes, absolutely.

One of the most appealing aspects of driving for Uber is the flexibility to work on your own schedule, as often or as little as you like.

I have clients who are single parents and drive during school hours. They can attend school events whenever they like, and stay home when a child is sick without worrying about job security. I also look after a large number of students who fit Uber in around their classes and study schedules. They can crank up their hours during semester breaks, and reduce their hours in the leadup to exams. And many drivers don’t drive regularly, instead just jumping on the road when their family needs a top-up of cash for a holiday, unexpected bill, or Christmas presents for the kids.

This is by far the biggest benefit of the gig economy, from ridesharing, to Fiverr to Airbnb. Anyone can do it, whenever it suits them. What other job offers that kind of flexibility? The trade-off, of course, is that take-home pay tends to be lower than an employee job, with some drivers earning below minimum wage.

Ultimately, the question you need to ask yourself as a prospective Uber driver is whether the trade-off between lower wages versus complete flexibility is worthwhile for you.

What Next?

If you decide to go ahead and start rideshare driving, DriveTax has a bunch of resources to help you.

The first thing you’ll need is our Free Uber Tax Info Pack. It includes a 5-day email course on ‘Uber Tax Essentials’ which will teach you all the basics you need to get started. You’ll learn how to register with the ATO, how to keep a logbook, and all the tax deductions you can claim. You’ll also get our Free Uber Spreadsheet, which includes an ATO Logbook, and also our ATO Registration service so you can get your ABN and GST Registration from the ATO for free.

If you want to dig deeper, check out our Understanding Uber Taxes online course. It includes 30+ video lessons explaining everything you need to know about tax for Uber, step-by-step video tutorials on how to lodge your own BAS’s and tax returns, and so much more.

All the best with your driving!

Thoughts? Questions? Leave a comment below and I’ll respond shortly! – Jess

About the Author – Jess Murray CPA – Uber Accountant

Jess Murray is a CPA Accountant and registered tax agent. She’s been working in personal and small business tax for 15 years, and has been specialising in tax for Australian Uber Drivers for the last 7 years as the Director of DriveTax. She also teaches an online course called Understanding Uber Taxes.

Jess is on a mission to make taxes straightforward and manageable for Uber drivers across Australia.

The information in this article is general in nature and does not take into account your personal circumstances. If you’d like to know how this article applies to you, please contact us to arrange a consultation, or talk to your accountant.

I read through this and I think it’s a complete waste of time and really doesn’t answer the question of what does a Uber driver make.just lots of confusing mathematical solutions and examples

Hi Ed, It sounds like you’ve captured the point of the article perfectly. Predicting your Uber profits is almost impossible, and in my opinion so complex and so inaccurate that it’s a waste of time. There are a huge number of variables, and alot depends on personal factors, so it’s virtually impossible to predict. And your results will be different from any other driver for a range of reasons, so there’s no point in comparing. So the point of this article is that any attempt that we make is probably futile, and the only way to really find out is to start driving yourself, in your car, in your area, on your schedule. – Jess

Hi Jess.

I’m an Uber X driver in Cairns QLD. I’m thinking of upgrading to the Uber XL platform.

I would need to up grade the current vehicle

Without a to complex response in a nut shell do you think it is worth it ?

Hi Alan, this is a very personal question so it’s not one that anyone else can answer for you. It depends on the demand for XL in your region, what times of day and days of the week you’ll be driving, the cost of the particular car you’re looking at, the financing options available to you, your marginal tax rate, your family budget, and a number of other factors. I recommend checking out our article on Buying a Car for Uber for more information. – Jess

This is not correct

Uber is charging something between 40-50% of each ride

As an Uber driver I am talking to my customer and they’re saying how much Uber is charging them and when I receive the money I see Uber has taken half or sometime a bit more than half of that money. This is not fair at all

Hi Mo, Uber change their rates regularly, so the rates mentioned here might be out of date. I can’t speak to Uber’s business strategy or profits, but I certainly understand that depending on your factors mentioned above, it can be tough for Uber drivers to make a profit. ! appreciate your perspective. – Jess

I’ve been working Ubereats for over 5 years. It is definitely becoming much less worth it when taking into account costs and the fact they have recently reduced our pay 30 – 50 percent. That’s a serious pay cut during a cost of living crisis. I understand similar pay reductions have occured with Uber ride drivers.

Jess runs a great business though nothing to do with her she is polite and professional and would recommend her for any tax related issues

Hi Jess, great info, thanks. Driving in regional NSW is a tad different to City driving. When in the city I was averaging $2 per km. Now in regional area the return is a poultry .85c per km. The reason being that dead miles are so much more in the regions. Longer pickups and sometimes longer return trips where a return fare is extremely difficult to find. This means return on time is poultry and subsequently drivers opt to become point to point licence holders and use Uber to gain customers. This in turn means drivers undertaking cash jobs etc etc. It is a pity that the cost of dead miles is not deductable or could it be argued that they should be?

Hi Ian, actually dead miles can be included in your logbook, so they are deductible. You can read more in our article about Keeping A Logbook for Uber. – Jess

It’s not just the country KMs Uber has changed the algorithm. They don’t compensate for KMs travelled as they did in the past. It was confirmed to me by an Uber staff member.

Hi Jess,

If I was to buy a used car to use for Uber, would this reduce the deprecation I can claim? Obviously it’d be based on the vehicle build date and useful life?

Thanks

Hi Omair, depreciation applies exactly the same whether you buy a new car or a used car. You can still claim the whole cost of the car that you paid, and you will still use either the TFE write-off or 25% diminishing value method. – Jess

Hi Jess, do I need to register for GST if I want to do delivery for UBEREAT and Menulog ?

Kind regards

Ben

Hi Ben, I recommend jumping over to our blog post on Tax For Food Delivery Drivers, that will answer your question. – Jess

Hi Jess,

Lets say I work full time attracting 34.5% marginal tax rate and I want to buy a new car on a chattel mortgage. I decide to drive for uber in my spare time (for the term of my loan) clocking up KM’s and say use the car 60% for uber and 40% for personal use… I might only make $200 gross per week. does the following apply:

– 60% of expenses ie loan repayments, insurance, rego, gst etc is tax deductible and if those expenses are more than my earnings will be considered a loss against my total income?

– After I have paid the loan say 3-4 years and stop uber is there any tax liability for the car now being 100% personal use?

What I’m trying to achieve is buying a new car I will keep but making it a cheaper purchase overall as opposed to just paying it off after tax.

Hi Michael, if you earn less than $20,000 in gross income for the year and you make an overall loss, you cannot claim that loss against your employee income. Instead the loss is carried forward, and you can only claim it against Uber profits in future years. It is only if your gross income is over $20,000 that you can claim an Uber loss as a tax deduction against employee income. Once you stop using a business asset there will always be an adjustment for both tax and GST. I recommend checking out our blog post on Buying A Car for Uber, I think it will answer a lot of your questions. – Jess

Hi Jess, thanks for this wonderful source of info to help us.

is there any advice to buy a car using it for uber rideshare?

regards and best luck for everyone

Hi Esam, thanks for the great feedback! I’ve written a blog post on Buying a Car for Uber that I hope you’ll find helpful, and there’s also one on Renting a Car for Uber. – Jess

I think this is the perfect blog for those people who are finding the part time job. This is the best idea to make money by uber and after reading this blog i got all ideas in detail about how much people actually earn by uber. Really very informative blog. I will share this information with my groups. Thanks and keep posting!

Thanks for the kind words Marry! – Jess

Hi, I’m going to be moving to Australia permanently in early 2021 and have never lived or worked in the country before. I’m thinking of buying a car and becoming an Uber driver once I arrive, mainly to earn income until I find a permanent job based on my skills. I have a full UK manual license which I know is directly transferable to an Australian Category C license so no problems there. From anyone’s experience, is it worth buying a new car and becoming an Uber driver and how much on average would one expect to earn from this?

Hi Bhavik, welcome! You might like to check out the UberPeople Australia forum to chat to other drivers, and also our blog post on Buying a Car for Uber. I hope this is helpful! – Jess

Hi i was just wondering what year this article was posted?

Hi Tom, it’s evolved and been updated many times over the years! First publishing was probably in 2015 or 2016, which was before drivers had to register for GST. I have endeavoured to keep it up to date since then.

On the expenses side of things, not much has changed in the last few years. Uber fees in most states have been consistent, car running costs haven’t changed much etc. So the figures above are a reasonably fair reflection of the current tax figures being lodged by our clients. Remember though that they are just estimates, and there are many individual factors discussed above that will influence your personal outcome, such as what kind of car you drive, how you financed your car, how much non-Uber driving you do (i.e. your logbook percentage) etc.

But the real determination of how much you’ll earn from Uber driving is on the the income side, and it’s fair to say there are lots of factors that are constantly changing and impossible to quantify. Uber’s payment rates, Uber’s driver allocation algorithms, the number of drivers on the road, factors in your local area, the times of day you drive, and all the other variables mentioned above.

So as always, it’s impossible to predict what your personal profitability will be until you start driving and see how much you’re earning. But I hope the points above give you some ideas on what to expect and how to maximise your income. – Jess

Hi Jess,

Great information provided here, I fall into the 39c marginal rate and wondering what profit percentage you would calculate for this? Thinking it’s not worth it at all, especially if you haven’t even provided this chart?

Hi Lee, it works out to about 13%, and income tax around 12%. It’s up to you whether that feels worthwhile to you! – Jess

Hi Jess I’m wondering if you can tell me as an indicator Or if you have a resource that can be used indicate what an approximate earning For the times and the amount of time that you want to drive Uber. I’m curious as I’m trying to work out whether or not doing a little bit of extra work on top of a full-time job is actually worth while. The percentages you’ve given above are very helpful but not knowing how many hundreds of dollars you would expect to actually make is hard to determine whether it is worthwhile.

For example if I did one weekend night and to weekday nights of six hour shift so I total of 18 hours what would an approximate gross earnings rate in Uber be. I appreciate that’s a very loaded question but just a broad indicator would be nice for the purposes of doing basic calculations

Hi Ross, I’m sorry I don’t know the answer to this question. As I mentioned above, there are so many variables. As an accountant, all I receive from clients is their monthly summaries, which does not give any data at all about where they drove, whether it was weekdays or weekends, for how many hours, or any of the other variables that make up someone’s hourly earnings rate. So I’m sorry I just don’t have the ability to answer your question! I would suggest your best source of information would be to chat to local Uber drivers in your area, or to jump into online forums such as UberPeople (look for the Australia section). Hopefully you’ll find someone from your local area who can give you a better idea. – Jess

I earn 70000$ per annum. Is there any benefit to drive uber casualy with all the overhead expenses and tax and gst and cost of lodgements of tax returns.

Hi Manjit, the best answer I can give is written in the email above. The amount you’ll earn per hour varies depending on your circumstances, but it will almost certainly be lower than a normal employee job. So then it’s a personal question of whether you consider it to be a valuable use of your time. The answer is different for everyone! – Jess

Hi Jess, thanks for all the great information. I am wanting to purchase a car to start U er driving as I am studying and have children so want the flexibility. Can you advise me whether it is better to buy a secondhand car through a dealer (more expensive) or privately?

I am not sure about depreciation and claiming back expenses for buying a car for business?

Thanks in advance.

Hi Alana, from a tax perspective the only difference between buying through a dealer or privately is that if you are registered for GST (i.e. if you are a rideshare driver) you can claim back the GST on the purchase of a car from a dealer, but not from a private seller (subject to your logbook percentage). So let’s say you use a car 100% for Uber, a car that costs $11,000 from a dealer will end up costing you the same as a car that costs $10,000 from a private seller, because with the dealer car you can claim back the $1,000 GST. I also suggest checking out our post on Buying a Car for Uber. – Jess

Hi Jess,

Thank you for the informative article. I’m self employed and my company (Pty Ltd) is in the transport industry.

I read one of your replies regarding this issue and I just wanted to see if my situation is different.

Am I able to register with Uber with my transport company so effectively all my Uber revenue goes into that kitty. That gives my company another steam of revenue which I then draw my wage from.

Thank you again for this article and all your efforts in replying to the questions. It’s much appreciated..😀

Hi Damien, thanks for the great feedback! I generally don’t recommend using a company for Uber unless you have proper bookkeeping software and you employ a bookkeeper, because it is very difficult to account for Uber income correctly under ATO company accounting rules. Also, if your company is not already registered for GST then you don’t want to use it for Uber because then the company will have to register for GST and you will then have to pay GST on ALL the company’s income. If you can cover off these two factors, then directing the income through the company may be worthwhile. HOWEVER, whether it is actually legally possible to drive for Uber in a company depends on whether the invoices that Uber generates for your riders on your behalf can be changed to say your company name. Uber have changed this a number of times over the years, so you will need to check what the current position is. If the invoices can be issued with your company name and ABN, then you can drive for Uber in your company. One more note for anyone else reading this, if you do not already have a company set up as this driver does, I strongly do not recommend setting one up for Uber, as the cost of setting one up and having annual financial statements prepared will cost far more than any tax savings you may get. – Jess

If I drive from home to my full-time employment work, and then work to home this is not tax deductible obviously as it is completely a private expense. However, if I were to drive home from work, but be driving for Uber during this drive, and have it set to a particular Driver Destination (being home) but possibly picking up riders along the way, would this trip home then be tax deductible? If so, would it still be deductible even if I don’t manage to get any rides with the trip home?

Hi Ryan, the ATO have made a very specific ruling on this exact situation. If you are on the way to work or have some other purpose to your trip besides Uber, then only the kms that you have a passenger in the car are deductible. For the rest of the trip, the ATO considers your ‘primary purpose’ to be getting to work, even if you go out of your way, so the kms are not deductible. – Jess.

Hi Jessica – i understand that an Uber driver has to collect GST during the year. However, if at the end of the year our gross revenue is less than 75k, will we be provided a refund for any GST collected/paid?

Hi Jack, unfortunately no, the $75k threshold does not apply to rideshare drivers. – Jess

Hi Jess

I was an early Uber driver so the rake Uber takes from my fares is 20%

Now Uber is required to pay GST on their 20%

But they are forcing drivers to pay it for them by deducting a further 2% from every fare.

So Uber still pays no GST because they force drivers to pay it for them.

There is no doubt that drivers need to pay their own GST but Uber controls the rate charged to the rider and the riders haven’t been charged any GST.

I see a Class Action looming.

Your Thoughts

Graham

Hi Graham, I can appreciate your frustration. Unfortunately part of what drivers agree to when signing up with Uber is that Uber have complete control and discretion about fares and pricing. Drivers are free to choose to drive for Uber or not, they take a ‘like it or lump it’ approach. Something to note though, riders are charged GST, it’s baked into all the fares they pay even if it’s not specified, just as it’s baked into your fuel, groceries and every other purchase you make. Furthermore, Uber do pay GST on their income just as every other GST registered business in Australia. Uber may shuffle their fares and prices up and down, but everyone’s GST liabilities are set in stone. – Jess

Hi Jess, what a great site and article! Thank you for putting this info out there. I have a question regarding ABN etc:

I have an abn and a registered business name for another venture I started a year or 2 ago. I am not currently registered for GST. Do I need a separate ABN for uber? Or if I use my current one, will registering for GST be affective from the date or will I need to pay GST for my other business for the whole quarter it falls in? I hope I make sense, it’s all new to me. Any response is welcome :)

Hi Hazel, Thanks very much! We each only get one ABN for our lifetimes, and we must use that for all business income, just like we use our one TFN for all our employee jobs. You’ll need to register for GST from the date you begin driving, and that GST registration will apply to ALL your business income from that date forward. You’ll need to decide whether the money you earn from Uber will offset the extra tax you’ll have to pay on your other business income. All the best! – Jess

Hello, I’m getting Single Parenting Payments. How will earning money with uber effect my payments… I can’t afford to loose money from Centrelink but really needing the extra cash 🤷🏼♀️ Hoping you can help

Hi Alexandra, Centrelink will look at your net taxable profit from Uber. This is your gross Uber income (excl GST) minus your Uber tax deductions/expenses (excl GST). Obviously this is not easy to calculate, so you are correct that driving for Uber while receiving parenting benefits is complicated. You will need to talk to Centrelink to find out for your particular circumstances how much you are allowed to earn from Uber before affecting your parenting payments. Also, in some cases you will be required to report your Uber income and expenses fortnightly, which is a pain, so you need to talk to them to find out whether this applies to you. – Jess

Hey Jess

Great primer and heads-up on the entire Uber gig. Thank you!

I am in between jobs and setting up to “try” Uber for only 2 weeks, just to keep myself occupied, if anything. I’ll be leasing a car solely for this purpose. I understand that I’ll have to file a BAS once I start uber-ing. Here’s my question, when I put my uber hat down in 2 weeks, will I need to continue to file the BAS every quarter ad infinitum after the single intra-quarter uber stint?

Awesome job and thanks again!

– Mike

Hi Mike, thanks for the great feedback! You can certainly cancel your GST registration if you decide to stop Ubering, and then you won’t have to lodge any further BAS’s beyond that quarter. You can cancel your GST registration easily by calling the ATO on 13 28 66. All the best with your driving! – Jess

Hi Jess, thanks for the great website.

I am thinking of hiring a car for the sole purpose of Uber driving (my car is too old to Uber drive in anymore) As long as I keep a log book to prove the car is only used for work, can I therefore claim all the cost back for GST and to reduce my taxable income?

It will be about $199/week so I need to ensure it is worth it. There is also a $275 joining fee would this also be claimable?

Thanks in advance. Alison

Hi Alison, yes absolutely, the hire costs and other associated costs are all deductible. The GST can be claimed back on your BAS and the rest of the cost can be claimed as a deduction on your tax return, both subject to your logbook percentage of course. – Jess

Hi Jess,

I’m amazed with what you’re doing.

Good on you Jess. Very helpful!!

Jude

Hi Jude, thanks for the kind feedback! All the best with your driving too =) – Jess

Hi Jess,

I already have a business so am registered for GST, have an ABN etc. My question is whether I’m better off getting paid by Uber into my personal name or putting it through my business. I have an outstanding tax debt to the ATO in my persoanl name and this is my reason for wanting to drive UBer so I can pay this off. If every dollar I earn from Uber, apart from the GST, gets paid directly to the ATO them is it better to have it paid to me persoanally or into my business and then pay it to the ATO. My car is owned by my business and its covering the monthly car payments and fuel , servicing etc. I would appreciate your thoughts.

Jason

Hi Jason, I assume when you say business you mean a company or trust. The ATO have recently disallowed Uber drivers from driving in a separate legal entity, so this isn’t an option. All Uber drivers must drive under their personal ABN. I can’t give personal advice here, so Jason if I haven’t answered your question please feel free to contact us directly. – Jess

I wanna know,on bicycle how much money can be earned on getting 1 delivery.

Hi Asad, I can’t comment on how much you will earn, you will need to find this out from Uber. For information on claiming tax deductions you may like to check out our blog post on Tax for Food Delivery Drivers. – Jess

Hi Jess,

I would like to set up a Pty, ltd company in which I will be the only director and driving for uber will be the main source of revenue. The reason for this is I need to keep my personal income seperate from business profits and also keep seperate my personal affairs.

Will uber/ATO allow this type of an arrangement or will the ATO class all company revenue my personal income? Any information you could provide regarding this would be great.

Thanks in advance.

Mick

Hi Mick, the ATO are currently reviewing this, and so far it seems likely they will forbid Uber drivers from trading in a separate legal entity. I recommend waiting until they announce their final position, which should be published on their ridesourcing page on their website, before going to the expense of setting up a company. – Jess

Hi Jess

I am an uber driver. I do it part as I am student. I am registered with GST. My question is what is logbook? Where can I get one?

Do I need to record all expenses in it?

Thank you

Hi Zaher, you can read more about logbooks in our blog post on Tax Deductions for Uber Drivers. A logbook is just for recording kilometres, your expense records are separate. There is more information about keeping expense records in our blog post on Seven Steps for Sorting your Uber Tax Obligations. – Jess

Hi Jess, well structured article, most of the questions related to ride sharing are answered automatically. However, i would like to your opinion on it.

I have a company registered abn and gst Registration which i obtain to start one one of my venture, which never happened, so my question is can i use the same company abn and gst to do uber and at the same time be a Taxi Service Provider or Booking Service Provider as per the new point to point regulation. Not to mention using same company for both purposes.

Thanks and Regards

Ray

Hi Ray, generally speaking you can use your company for any business or purpose, or multiple purposes at once. However the ATO have recently been considering whether they may disallow drivers from trading in a company. We have been waiting for three months now for them to respond to us, and they haven’t advised yet, but we will advise once we hear back. You should consider this uncertainty when deciding whether to drive for Uber in a company. – Jess

Thanks Jess it was so kind of you for taking time out and answering my query. I will keep that in mind now. Trust you had a Merry Christmas and wish you a great year ahead.

Regards

Ray

Hi

I have SUV which I hardly use. Is it possible if I give my car to someone who willing to be Uber driver?

HI Sagar,

Yes, you can rent out your car to Uber drivers for a rental fee. You must have an ABN, but you don’t have to register for GST if you are not rideshare driving, just renting out your car. You must declare that income in your end of year tax return, and you can claim the car running expenses that you pay for (but not the expenses that the Uber driver pays, such as if they buy their own fuel). If you need more detail on this please contact us for a consultation. – Jess

If I earn below $18,000 from Ubereats which is my sole source of income, do I need to file any tax return or any other documents to any Government agency?

Hi Joe,

Yes, normally if you earn under $18k you don’t have to lodge a tax return, but there are different rules if you have an ABN. If you trade in a business at all, even if you only earn $1 of sales, you must lodge a tax return. – Jess

Thanks for a genuinely helpful website. Well done.

I appreciate the feedback, thankyou!! – Jess

Hi Jess,

I am a full time carer for my wife, so I’m on a Disablity Pension with my wife. I have spoken to Centrelink and they said if I drive for Uber I need to fill out a Mod F form and a Profit and Loss Statement Form. Do you know much about that? If so I think I’ll sign up. All a bit daunting. Cheers Chris

Hi Chris, the Centrelink forms are a pain, because they ask you to prepare a profit & loss as if you were a much larger business. For most people this means paying accounting fees to get it done for you. To prepare the form you would need to have figures to show what your Uber income and expenses are, so you really need to be driving for at least a few weeks or more so you can get an idea of what these will be. The choice is yours whether this is worthwhile for you! We can certainly help with the forms if you like, provided you’re able to supply us with information about your income and expenses. Feel free to contact us if you decide to go ahead, and I can give you more detail on our pricing and what information we need. Jess.

Hi Jess

I already drive Uber – over a year now ( thought it would only be a few months)

I have a small service company which owns my car and has the Abn and GST. I have some income in that but not enough.

I have put all my Uber income into the Company (bank account) as it handles all the expenses and the GST.

Is that OK? Or does Uber have to be in my name only and have my own Abn and GST?

Should I do a letter or “Board meeting minute” to accept that the Company is doing the Uber work?

Thanks

Hi Arthur, your situation is a bit too complex for me to advise here. But to give you a general answer, you can choose to drive for Uber in a company or a sole-trader, the choice is yours. Your decision should be based on the tax implications and on the additional complexities of trading in a company. Feel free to book a consultation if you’d like to discuss this in more detail. – Jess

I haven’t driven for Uber for a long time (4 months) and made money with other business not claiming GST to customers. Now lodging BAS, can I de-register on the last day I driven Uber and don’t have to pay GST on income I made later?

Hi Rob, yes you can. If you have stopped driving for Uber and don’t plan to recommence in the foreseeable future you can cancel your GST registration, and backdate your registration date to the last date you were paid from Uber. – Jess

I love the website! I’d love to see a similar article for UberEats drivers on a bicycle. I don’t have that many expenses such as fuel, how much would I be able to keep in the end? Do drivers on a bicycle have the same ‘rules’ as drivers in a car?

Hi Sander, we don’t have quite this level of analysis for bicycle delivery drivers as we don’t have as much data on their average costs. However, if you haven’t seen it yet our blog post on Tax For Food Delivery Drivers will hopefully give you some information and tax tips. Jess

I don;t know where in Australia GST is only 7%???

Hi Lucinda, I think you’ve misunderstood. You’ll pay GST of 10% on your income. You’ll then claim back GST of 10% on any expenses that include GST. So based on the income and expenses of our average Uber driver client, the net GST you’d end up paying, as a percentage of your income, is around 7% of what you earn. Feel free to email me if you’d like a more detailed explanation. Warm regards, Jess

Thank you

Hi,

Would that be much different for taxes purpose say if i ‘rent’ the car from a dealer to do Uber instead?

Assuming i can somehow deduct some of the taxes off the rental as a cost of sales/services?

Thank you

Hi,

The cost of renting/hiring/leasing a car is tax deductible, and you can claim the GST on that cost as well. Whether it is better to rent or own is different for every person, so that’s not something I can answer here.

Remember to claim the tax deduction you must have a logbook.

– Jess

It is my understanding that unless your earn more than $70000 from your uber business or any business wether it is part time or not, you don’t need to collect GST nor do you have to be registered for GST.

When it comes to tax time, you just add it to your personal tax? Am I wrong in assuming that?

Hi Simon, that is true for most businesses (although it’s $75k, not $70k), but there are different rules if you are a tax driver or otherwise transporting passengers for money. If you’re driving for UberX or any other ride-share company you must register for GST even if you are earning less than $75k. You’ll also pay income tax at the end of the year as well. Check out our Complete Guide to GST for Uber for more detail – Jess

Hi Jess,

Great website!

I’m looking to work Uber a small amount while a student. Do you use the figure ‘Taxable Income’ or ‘Net Taxable Profit’ to know which taxable income bracket you would be in? (After tax deductions can you fall into a lower tax bracket?).

Thank you,

Oliver

Hi Oliver, those terms are a bit confusing. Your ‘Net Taxable Profit’ normally relates specifically to your Uber/business profit. This taxable profit is added to your other kinds of taxable income (e.g. employment income, bank interest etc), then your tax deductions are subtracted, and the result is your ‘Taxable Income’. Your marginal tax rate is based on your taxable income. I hope this explains it! – Jess

Hi Jess,

I am thinking about drive UBER and wants to buy newer car, i do have ABN…

should i buy car under the ABN or as personnal?

should i insure car as commercial vehicle or as private?

what are the process best way to do to make easier for tax clime as well..

this going to be my second job wt are the tax rate?

what alse can i clime :

car expediences, insurance expenses, fuel, maintenance etc

of course i will be useing newer car business as well as for private use…

can you please explain a bit above topics..

Thank you

Ramesh

Hi Ramesh,

Thanks for your questions. It doesn’t matter whether you quote your ABN to the car dealer or not, you can claim the car purchase either way. However you must be GST Registered on the date you buy the car if you want to claim the GST back. With regards to insurance, the ATO doesn’t care whether your policy is business or private, it’s tax deductible either way. However your insurance company may require you to have a business policy if you’re driving for Uber, and may not cover you if you have an accident and did not tell them beforehand. Every insurance company is different so be sure to ask yours what their Uber conditions are.

You’ll find the answers to the rest of your questions on our blog. Check our our article on the Seven Steps to Sorting your Uber Tax Obligations. It gives a great overview of all of these topics.

All the best with your Uber driving!

Jess

Hi Jess, I just recently joined Uber. Regarding the Car logbook, should I record every trip that I took, If I took 20 trips in a day? Is every single trips mileage have to written on the logbook? or just the starting mileage of the day and the end of the day? Thank you

Hi Choon. You only have to record your odometer reading at the start and end of each Uber session, not for individual trips. This is because the ATO allow you to claim the kms between each trip, and your journey to and from home as well. Much easier! – Jess

Hi Jess,

According to the net income calculation, it seems you calculated base on the gross income (including the Uber fee). So I would like to question would the taxable and GST base on the gross income or the net income (the money in your bank account after deducting Uber fee)?

Thanks,

Toni

Hi Toni,

I find that it’s easier for drivers to have a ‘rule of thumb’ percentage to put aside that’s based on the net amount they receive in their bank account. That way, they can calculate how much to put aside based on the dollars in their bank account, no need to look back at Uber statements to see what the gross was.

From a tax perspective though, GST and income tax are both based on the gross (with the Uber Fee being an income tax deduction).

I hope this answers your question!

Jess

Im sorry if this sounds a bit silly, but let me get this straight.

Uber does not charge the rider for GST, and Neither does the driver!! However the ATO wants the driver to pay back the GST which he never charged the customer? I understand that as a contractor when you have control of charging your clients GST on top of your services, you are than obliged to pay the GST back to the government. However if you are not charging GST, why are you required to pay GST to the government?

HI Paul, I see your point, but the driver DOES charge the rider GST, and this is not optional. Uber driving fits within the tax legislation definition of taxi driving, and therefore drivers must register for GST and remit 1/11th of their gross earnings to the ATO.

So Uber does not charge any GST to the rider. Uber also pays the toll ex GST and Govia charges the driver the toll inclusive GST.

Uber keeps 25% of the fare and although I do not receive this money, I have to pay GST on it! I thought we only pay GST on the amount we do receive in our hands.

My question is the following:

As a business owner (sole trader), ABN and GST registered, am I allowed to invoice Uber for GST not charged to the rider? After all, as a “contractor”, I should invoice my customer (in this case Uber) for any GST they do not pay me from the riders’ shares.

ATO cannot claim that the financial transactions are directly with the rider. Uber is the centralized payment hub for all rider’s reservations and payments accounts. We as driver cannot charge the rider for GST although they ride in Australia, with drivers registered in Australia.

I have been contracted by Uber in Brisbane, in an existing office by Uber staff working in Brisbane. Not by a virtual company sitting overseas via Skype.

Maybe if all Uber Drivers that are fully ABN and GST registered do send invoices to Uber for the GST they have not received and they have to pay ATO, Uber might consider setting up new rules that would fit in the Australia tax system and doing so will have all the ammunitions to fight the Taxi Association.

Thanks for any response.

Hi Marc. Thanks for your comment, I appreciate your point of view.

The ATO’s perspective is that your transaction is directly between you, the driver, and your rider. They see Uber as just a software that you each use to speak to each other, a middle man. As a similar example, if you were to advertise your car for sale on a car sales website, that website would be the middle man, the actual transaction would still be between the buyer and the seller. So for Uber, you pay fees to them as the middle man for their assistance, but the main service is performed by you the driver, for the rider. And since you and the rider are both physically in Australia GST will apply to that transaction. Uber is a tax deductible fee in the course of doing business so it is certainly a tax deduction. However since they are not Australian they have not charged you GST on their price, so there is no GST to claim back. I appreciate there are different ways to look at it, but ultimately the ATO set the laws!

Hi Jess

My friends and I want to get an A.B.N., register for G.S.T. and then buy a new car to drive for Uber.

Being able to depreciate the full cost of the car in the first year as an Uber driver is the goal.

So can Uber drivers in Melbourne take advantage of the $20,000 instant write-off for small business assets?

Thanks.

Mike

Hi Mike,

Thanks for getting in touch. I’m not sure whether you mean you’re each buying a car, or whether you’re going to buy one car between you. However the answer regarding the $20,000 write-off is the same regardless. Yes, you can absolutely claim the up front write-off. The only requirement is that your business turnover is below $2 million. The tax concession is currently scheduled to close on the 30th of June 2017. Keep in mind though that depending on your level of profits, you may not be able to use all of those tax deductions in the one financial year, and they may instead be rolled forward to be offset against future profits.

If you’re considering buying the car together, there are a few other tax implications that you need to be aware of, so please get in touch if you’d like further advice.

All the best!

Hi Jess,

If I lease a car, how is the GST that I pay on the lease treated? Also can I use a portion of the lease as an expense in my income tax?

Hi Ian, assuming you’re paying the lease yourself directly, you can claim a percentage of the GST back on your BAS’s, based on the percentage you’re using your car for Uber. The remainder (the GST exclusive portion) can be claimed as a tax deduction, provided you’ve kept a logbook to determine your deductible percentage.

Note that if your leased vehicle is salary packaged from your employer the answer is different. Your employer would likely already be claiming the GST credits, and you couldn’t claim a tax deduction because you’re already getting the tax benefit by way of your salary packaging. If you need more detail on this Ian, feel free to email!

Jess.

Hi Jess, have you included your accounting expenses in the example? Am I correct to say they are in year 1, if we use DriveTax to do all things: GST registration $66 4 x express quarterly bas @ $99 and annual return $220 total year 1 = $682

Are all these expenses deductible?

Tim

Hi Tim,

These calculations use an average of all types of expenses incurred by Uber drivers, including accounting fees.

Your calculation of fees is absolutely correct. The GST can be claimed back in your BAS’s ($682 / 11 = $62 in GST), leaving a net cost of $620 which you would claim on your end of year return. The amount you get back from this would depend on your marginal tax rate.

Note that in reality your timing will be a little different from this, because your April-June (Q4) BAS and your end of year tax return would be paid for after the 30th of June, so would be claimed in the following financial year’s tax return.

I hope this answers your question Tim!

Jess