How To Keep A Logbook For Splend

Updated 28th of June 2024

If you want to claim a tax deduction for your Splend fees, fuel and other car expenses, you MUST keep a 12-week logbook of your Uber, rideshare or food delivery driving.

If you don’t have a valid 12-week logbook the ATO will not allow you to claim car deductions for your Splend fees or any of your other car expenses.

Instead you’ll be stuck with the ‘cents per kilometre’ method, which for most drivers will mean a much lower tax deduction and therefore a higher tax bill.

So in this article, I’ll explain everything you need to know about keeping a logbook in order to get the maximum possible tax deduction for your car expenses.

We’ll look at why you need a logbook and what happens if you don’t have one, how to keep a logbook of your rideshare and food delivery driving, which trips you can and can’t include, and some quick tips to maximise your logbook percentage.

Quick Links

> How To Keep A Logbook

> Which Trips To Include

> Uber Logbook Example

> How To Calculate Your Logbook Percentage

> Tips To Maximise Your Percentage

> Get The FREE DriveTax Logbook & Expense Spreadsheet

Keeping A Logbook For Your Splend Vehicle

What Is A Logbook?

A logbook is a record of your car’s odometer readings kept over a continuous 12-week period.

If you want to claim a tax deduction for your Splend fees and other car expenses, the ATO’s rules state that you MUST have a logbook as evidence of the percentage that you use your car for business vs private use. You can then claim that percentage of your Uber car expenses.

These rules apply even if you use your car 100% for business. This is because the ATO still need evidence that your car is actually 100%, they cannot just take your word for it.

If you don’t have a valid logbook, you cannot claim tax deductions for your actual car expenses. Instead you can only claim a cents per kilometre deduction, which is usually a much smaller tax deduction. This is why a logbook is so important, because for most drivers it results in a much bigger tax deduction, meaning much less tax to pay to the ATO.

What Tax Deductions Can You Claim With A Logbook?

Once you have kept your 12-week logbook, it will show exactly what percentage you use your car for business vs private/other use. You can then claim a tax deduction for all your car’s running expenses multiplied by that percentage.

Here are the car deductions you’ll be able to claim for Uber, rideshare and food delivery. (Not all of these will apply to you because Splend cover your car’s registration, maintenance and insurance costs for you, but I’ve included them anyway for completeness):

- Splend Fees

- Fuel or EV Charging

- Cleaning

- Accessories

- Insurance

- Registration

- CTP

- Repairs & Maintenance

- Tyres

- Interest

- Depreciation, Instant Asset Write-Off, Immediate Expensing

Once you’ve totalled up these car expenses for the year you’ll multiply them by your logbook percentage to get your final car tax deduction. Here’s a simplified example of how this would work for a full-time driver:

+ Fuel: $15,000

+ Splend Fees: $13,900

+ Cleaning: $1,800

= Total Car Expenses: $30,700

x Logbook: 80%

= Tax Deduction: $24,560

If you’d like more detail on claiming tax deductions for Uber, rideshare or food delivery, including what records you must keep in order to claim, you’ll find some useful links at the end of this post.

Claiming GST on Car Expenses on your BAS

The rules are a little different for GST and BAS’s. A logbook isn’t required for BAS’s, only for tax returns. If you’re GST-registered, to claim the GST on your car expenses on your BAS you just need to make a reasonable estimate of your business use percentage, a logbook isn’t required.

If you have kept a logbook then you should certainly use that percentage, but if you haven’t started a logbook yet that’s okay, just estimate your business-use percentage instead. But as I mentioned above, when it comes to your end of year tax return, if you don’t have a logbook you’ll pay far more tax than necessary, so be sure to get a logbook started pronto.

The Cents Per Kilometre Method

If you don’t have a valid 12-week logbook you will NOT be allowed to claim a tax deduction for your Splend fees, or for your fuel or any other car expenses. Instead your only option will be the cents per kilometre method, which will give you a much lower tax deduction and therefore a much higher tax bill.

Calculating Your Kilometres

With the cents per kilometre method there’s no recordkeeping necessary. Instead you just have to make a reasonable estimate of your business kilometres for the financial year, up to a maximum of 5,000km per vehicle. To make a ‘reasonable estimate’ you must put proper thought into your calculation rather than just guessing, and you must be able to show the ATO how you worked out your result.

- Example 1 – you usually drive rideshare 3 times per week, for about 5 hours each time. You have worked out that in an average 5-hour session you do around 200km. You started driving in May so you drove for 8 weeks of the financial year. So you calculate 200km x 3 sessions per week x 8 weeks = 4,800km

- Example 2 – you drive for Uber and on your monthly tax summaries you have added up the ‘On Trip’ kms for the year to be 3,800km. But this doesn’t include kms in between trips, or driving to and from home at the start and end of your trip. You estimate that these extra kms that Uber don’t include would add another 50% on top of the on-trip kilometres, bringing the total to 5,700km. This means you can claim the maximum 5,000km.

Note that if you had multiple vehicles during the year you can claim up to 5,000km per vehicle. So for example if you changed vehicles halfway through the year you could claim up to 5,000km on the old car plus up to 5,000km on the new car.

The Cents Per Kilometre Rate

Once you have your estimated kilometres you’ll multiply this by the ATO’s cents per kilometre rate for the financial year as follows:

- 2022-2023 – 78 cents per km – maximum claim is 5,000km x 78c = $3,900

- 2023-2024 – 85 cents per km – maximum claim is 5,000km x 85c = $4,250

- 2024-2025 – 88 cents per km – maximum claim is 5,000km x 88c = $4,400

Going back to the full-time driver in our example above, there’s a HUGE difference in the tax deductions they’d be able to claim with a logbook ($24,560) vs no logbook ($4,250). If our example driver didn’t keep a logbook they’d be missing out on $20,310 worth of tax deductions, which at the 32% tax bracket would mean he’d be paying an extra $6,499 of tax. So as you can see, keeping a logbook can save you a substantial amount of tax, and is well worth the trouble.

One exception to this is if you know for sure that you’ll be under the tax-free threshold. If you already have no tax to pay then you don’t need any extra tax deductions. So if this applies to you, you may prefer to skip the hassle of keeping a logbook and just stick to the cents per kilometre method instead.

Just for clarity, the cents per kilometre method cannot be used for GST and BAS’s, it is only for tax returns. As mentioned above, when it comes to BAS’s if you haven’t kept a logbook you can still claim the GST on your car expenses, just estimate your percentage and use this to claim the GST on your actual expenses. It also cannot be used for scooters, bicycles and motorbikes, again you must estimate your percentage and claim this amount of your actual running costs.

How To Keep A Logbook

The ATO don’t mind how you keep your logbook, as long as it contains all of the required bits of information. It’s important to note that you cannot just use your Uber app records or Splend records as a logbook, because both of these data sets don’t record your odometer. No odometer readings = no logbook!

Here are the main four options for keeping a logbook of your driving:

Pen & Paper

The biggest benefit of using a physical logbook is that you can sit it somewhere visible in your car to remind you to record your odometer reading every day (especially handy if you’re forgetful like me!). It also means you don’t have to juggle yet another app, which can be helpful if you drive or deliver for multiple companies. The downside is that at the end of the 12 weeks you’ll need to sit down and add up those kilometres manually with a calculator or spreadsheet. If you choose this option I recommend the Zions Pocket Logbook from Officeworks which costs around $8 (look for the yellow cover).

App

Apps make keeping a logbook super easy, as long as you don’t forget to fill it out every day. We’re so used to carrying our phones all the time so it’s easy to forget when you jump in the car each day. The biggest benefit of an app is that it tracks your percentage as you go, and you won’t need to do any adding up. There are a range of apps for both Apple and Android, but make sure you choose one that is ATO-compliant. Remember, an app can’t do the whole process for you automatically by GPS because an app can’t read your car dashboard. Again, no odometer readings = no logbook!

Spreadsheet

Another option to have all the adding up done for you is a logbook spreadsheet. You can download the FREE DriveTax Logbook and Expense Tracker Spreadsheet here to try it out. To easily grab your odometer readings I suggest using your phone to snap a photo of your odometer at the start and end of each shift. They’ll be time-stamped so you’ll know later what date they related to.

Vehicle Data Tracker

If you’re looking for a fully automated solution you may like to consider GoFar. GoFar is a vehicle tracking device that plugs into the diagnostics port of your car so that it can access your odometer readings and log your trips. You then use the tracker’s app to tag each trip as business or private. It’s a sleek-looking unit and has a well-designed app, the company is Australian so you can be sure it’s ATO-friendly, and as bonus it also includes a tool to help increase your fuel mileage and driving efficiency. The GoFar costs $120 for a year, so it’s not cheap, but if you’re a full-time driver and you think you’ll benefit from the tracking and efficiency tools then it may be worthwhile.

How To Enter Logbook Trips

Requirements of a Logbook Trip Entry

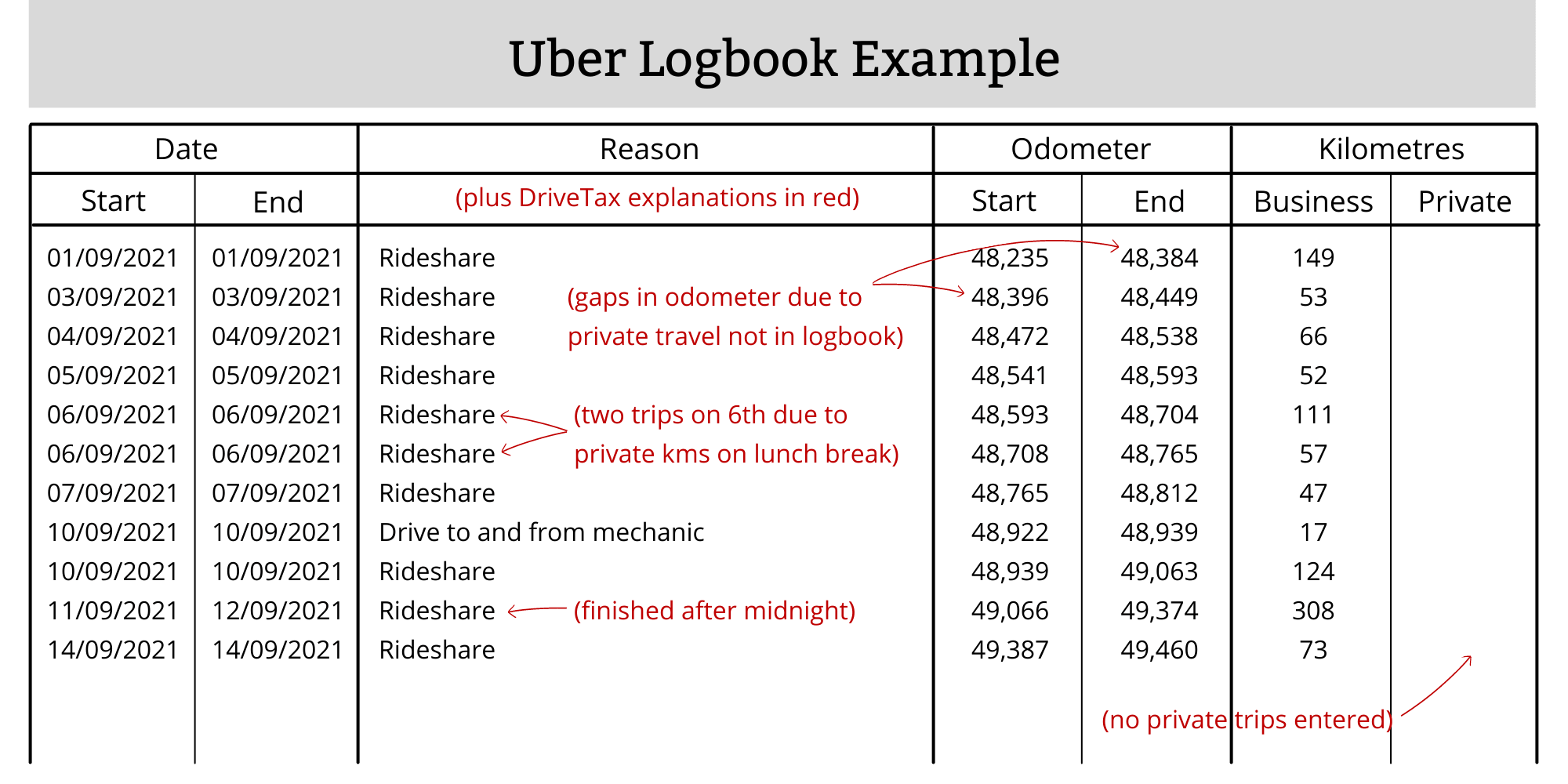

To count as a valid logbook entry, the ATO require you to include the following data for each trip:

- Start Date and End Date – these will usually be both the same unless you finished after midnight

- Reason for Trip – you can just write ‘rideshare’ or ‘food delivery’

- Odometer at Start & End of Trip – you must record your odometer readings from your car dashboard

- Total Kilometres – calculate this as the end odometer minus the start odometer

Scroll a little further down to see an example of what this might look like.

What Counts as a Trip?

You only need to record tax-deductible trips in your logbook, you do not need to record personal/non-deductible trips. This will save you a bunch of data entry!

You only need to record one logbook entry per driving shift/session. For example if you did a 5-hour driving shift with 20 passengers/deliveries, that is still just one logbook entry. All of the kilometres driving to pick up passengers/deliveries and in between passengers/deliveries are included in this one logbook entry.

Usually you can take your odometer readings from when you leave home until you arrive back home, even if you have the app switched off for the first or last part of your journey. This is a special rule for businesses, and is different to the rules for employees who normally cannot claim travel to and from home.

However, if you make a personal trip before or after your shift, for example you drop your kids at school and then switch on the app, or you stop by the supermarket on your way home, then you must record the odometer at the point when you switch the app on or off, rather than from home.

If you take a meal break during your shift which involves driving somewhere specifically to get food, then when you turn off the app you must record your odometer to end that logbook entry. Then when you turn the app back on you’ll record your odometer again to start a new entry. This is because the ATO considers meals to be private, so kilometres that are solely to drive and get food cannot be counted in your logbook. On the other hand, if you are just cruising in between trips and you happen to pass by a bathroom or food place and decide to stop then you don’t need to to make a separate logbook entry because there were no kilometres that were specifically private. (I realise this is a bit fuzzy, just use your best judgement!)

The ATO rules are a little different if you pick up a rideshare passenger on your way to or from your employee job (or on any personal journey). In this situation you can only claim the kilometres for which the passenger is physically in your car, you cannot claim the kilometres between accepting the ride and picking them up, or any other kilometres on your journey. This is because the ATO does not consider those other kilometres to have the sole purpose of business, they also have the personal purpose of getting you to work (remember travel to and from an employee job is personal). So in this situation you’ll need to note your odometer readings as your passenger is jumping into your car and again when they jump out.

If you also have an employee job for which you have tax-deductible travel that you want to claim (e.g. travelling to meetings or courses) you must record your employee trips in your logbook also, and make sure the reason is clearly marked as ‘employee’. This is because you must use the same claiming method for both business and employee travel, either the cents per kilometre method for both or the logbook method for both, you cannot mix and match. Remember the rules for which trips you can claim are different between business and employee travel (e.g. to and from home is deductible for business but not for employees), so pay close attention to which trips you include in your logbook.

The same applies if you have another ABN business that you use your car for, be sure to include these in your logbook too. Make sure in the reason section they are clearly marked as being for your other business.

Travel for other things that are directly connected to your rideshare or food delivery work can also be included in your logbook. This includes things like car maintenance, vehicle checks, attending training and visiting your Splend Member Centre.

Other Logbook Requirements

A valid logbook must go for a continuous 12-week period. This can be any 12-week period of your choosing, but it must be representative of your travel throughout the year. See the Logbook Tips below for more on this.

In order to be valid for a particular financial year, your logbook must begin before 30 June of that year. It’s completely fine if the logbook runs past 30 June and into the next year, as long as the start date is before 30 June (although you’ll have to wait until the 12 weeks are complete before you can lodge your tax return). If 30 June has already passed for a given year it will be too late to start a logbook because it’s impossible to know what your odometer readings were once they’re gone, so you’ll have to use the cents per km for that year.

Once you have kept a logbook it is valid for five years as long as your ‘pattern of usage’ doesn’t change. However there is a little flexibility in this because naturally no-one’s travel is exactly the same week after week. The ATO specify a range of +/- 10% before they consider that your pattern of usage has changed and a new logbook is required.

Your logbook must also show your car’s details, including the make, model, engine capacity and registration number of your car, so make sure these are listed somewhere in your logbook. If you change cars during your logbook’s lifespan you may need to list more than one vehicle. But as long as your pattern of usage doesn’t change +/- 10% you don’t have to start a new logbook.

One final requirement is that you must record your car’s opening and closing odometer readings every financial year, even if you don’t have to keep a whole new logbook that year. I recommend popping a yearly reminder in your phone for the morning of 1 July to record your odometer reading for the new financial year.

How To Calculate Your Logbook Percentage

Once you’ve finished your 12-week logbook, calculating your percentage is easy.

- Add up the total business kilometres. Let’s call this A.

- Work out the total kilometres that your car travelled for the 12 weeks by taking the odometer at the end of the last trip minus the odometer at the start of the first trip. Your answer to this will be B.

- Calculate A divided by B, in other words the business kilometres divided by total kilometres. This will give you your logbook percentage.

If you have both business and employee kilometres in your logbook you just need to repeat the steps above but this time A will be your total employee kilometres. You should then end up with two different percentages, one to use in the employee section of your tax return and one to use in the business section.

Logbook Rules For Particular Scenarios

Changing Your Pattern Of Usage

If your pattern of usage changes by +/- 10% then you must start a new logbook, for example if you switch from part-time to full-time driving, or you switch from food delivery to also doing rideshare.

Changing Cars

If you change cars but your pattern of usage doesn’t change then you don’t have to keep a new logbook. Instead, your existing logbook just rolls right over. This commonly occurs when you buy a new car and sell/trade-in your old car, or if you use a rental car temporarily while your usual car is off the road for any reason. Don’t forget to make a note of the odometer readings of both cars at the time you change over, and to list the new car’s make, model, engine size and rego in your logbook.

Using Multiple Cars

If you use more than one car for rideshare or delivery driving at one time then you must keep a separate logbook for each vehicle, and both logbooks must cover the exact same 12-week period. The most common example of this is if you usually drive in your own car but sometimes use your spouse’s car. You’ll also need to keep separate records of each car’s expenses, you cannot jumble them together. As an alternative, if you only drive the second car occasionally you could keep a logbook only for the main car and use the cents per km method for the occasional car.

Tips To Maximise Your Uber Logbook Percentage

Your 12-week logbook must be representative of your travel throughout the year. But of course no-one’s travel is exactly the same every single week. So the ATO specify a range of +/- 10%, beyond which your logbook becomes invalid and you must start a new one.

So, whilst making sure we always comply with the ATO’s primary rule of the 12-week logbook being a fair representation, we naturally want to be on the + side of that range rather than the – side. With this in mind, here are a few tips for keeping your logbook:

Timing of Your 12 Weeks

Some times of year are busier than others, particularly for rideshare drivers. For example, in Melbourne the October-December period encompasses the later part of the Spring Racing Carnival, sometimes the AFL finals, the December Christmas Party season and New Years Eve. So you may try time your logbook period to incorporate at least a few of these major annual events so as to represent what a full 12 months of driving would actually look like.

There might also be personal factors that mean you drive more or less at certain times of year. For example, if you’re a student make sure your 12-week period includes some semester breaks when you’re driving more often.

If You Have Access To Another Car

If you have another car in the family, during the logbook period you may like to push more of your family’s personal driving towards that car and less personal driving in your logbook car. Don’t take this too far though, or your logbook won’t be a fair representation anymore.

Keep Your Logbook For Longer

If you’re really keen to get the highest possible logbook percentage, you may like to keep a logbook perpetually instead of just for 12 weeks. Many drivers choose to keep odometer readings year-round so that they can choose the most optimal 12-week period (within the ATO’s rules of course).

What Next?

If you’re looking for more ways to boost your Uber tax deductions and minimise your end of year tax bill, these pages on our website might be helpful:

- Learn more about Tax Deductions for Uber Drivers and Tax Deductions for Food Delivery Drivers

- For more on GST and BAS’s visit our Ultimate Guide to Uber BAS’s

- Get the FREE DriveTax Logbook and Expense Tracker Spreadsheet

- For a deeper understanding of keeping records of your expenses, maximising your car deductions, check out our Understanding Uber Taxes online course

Questions? Thoughts? Pop them in the comments below and I’ll get right back to you!

Safe driving! – Jess

The information in this article is general in nature and does not take into account your personal circumstances. If you’d like to know how this article applies to you, please contact us to arrange a consultation, or talk to your accountant.

About the Author – Jess Murray CPA – Uber Accountant

Jess Murray is a CPA Accountant and registered tax agent. She’s been working in personal and small business tax for 15 years, and has been specialising in tax for Australian Uber Drivers for the last 7 years as the Director of DriveTax. She also teaches an online course called Understanding Uber Taxes.

Jess is on a mission to make taxes straightforward and manageable for Uber drivers across Australia.

Leave A Comment